Is The Tax Year The Same As The Calendar Year. February 28, 2017 7 min read. Financial reports, external audits, and federal tax filings.

A tax year is a calendar year, but a calendar year isn’t necessarily a fiscal year. Government of india is thinking of change of financial year (april to march) to calendar year (january to december).

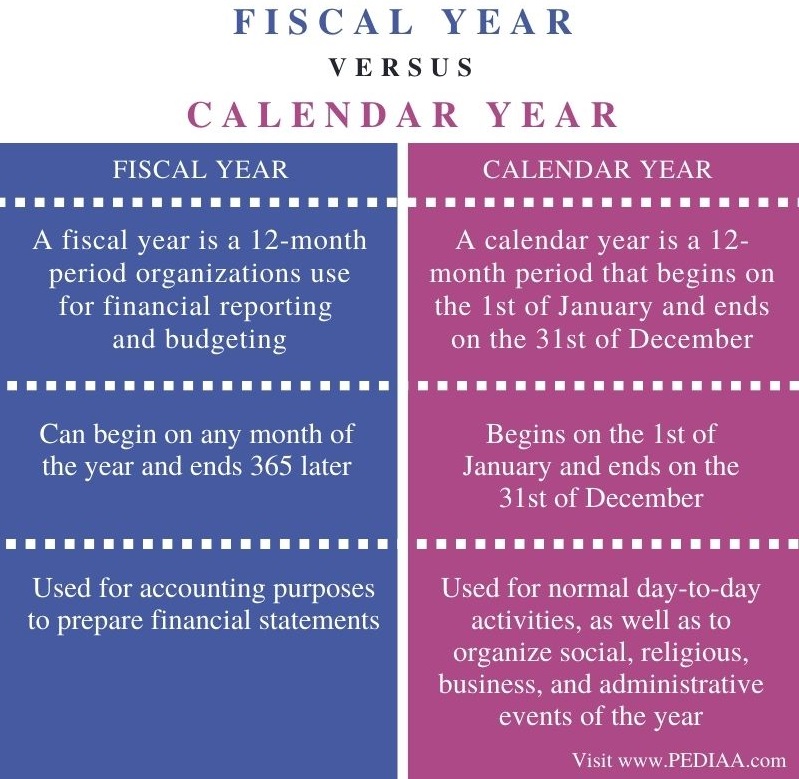

What is the Difference Between Fiscal Year and Calendar Year, A person's financial year is the year in which he or she receives money for tax purposes. The challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know, Financial reports, external audits, and federal tax filings. However, you choose the start date with the fiscal method, with that tax filing period.

How to Convert a Date into Fiscal Year ExcelNotes, A tax year is an annual accounting period (of 12 months) for which all our incomes and expenses are recorded and reported. What is a tax year?

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube, A person's financial year is the year in which he or she receives money for tax purposes. Financial reports, external audits, and federal tax filings.

What is the Difference Between Fiscal Year and Calendar Year, A tax year is a calendar year, but a calendar year isn’t necessarily a fiscal year. For tax, accounting, and even budgeting purposes, it’s important to know the difference between a fiscal year vs calendar year.

PPT Basic Accounting Concepts PowerPoint Presentation ID5002391, The challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. In the u.s., the tax year for individuals runs.

Calendar vs Fiscal Year for LLC or S Corp? what's the difference, For individual and corporate taxation purposes, the calendar year commonly coincides with the fiscal year and thus generally. For tax, accounting, and even budgeting purposes, it’s important to know the difference between a fiscal year vs calendar year.

Calendar Year Definition Accounting Month Calendar Printable, February 28, 2017 7 min read. The irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most.

Your Tax Fact Sheet for the 2025 and 2025 Tax Years Tax Accountant, Fiscal year vs calendar year. Tax implications of using the calendar year vs.

Fiscal Year What It Is and Advantages Over Calendar Year, 31 december as the end of the year was adopted by julius. The tax year can end at different times depending on how a business files taxes.

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)

For individual and corporate taxation purposes, the calendar year commonly coincides with the fiscal year and thus generally.